Low-cost, high-yield ETFs are appearing everywhere in financial headlines right now. With interest rates and inflation switching up, it’s no wonder so many investors are wondering if now is the right time to get into the game. For anyone curious about capturing a strong yield without emptying your wallet on fees, these ETFs are super popular across all ages and experience levels. Here’s my perspective on investing in low-cost high-yield ETFs in the current market, along with some considerations worth keeping in mind as you think about adding them to your portfolio.

Disclaimer: This article contains affiliate links. If you open an account through these links, I may earn a commission at no additional cost to you. Investing involves risk, including the possible loss of capital. eToro is not available in all countries. Eligibility depends on your region. Always consider your individual circumstances before making an investment.

Why Low-Cost High-Yield ETFs Get So Much Attention

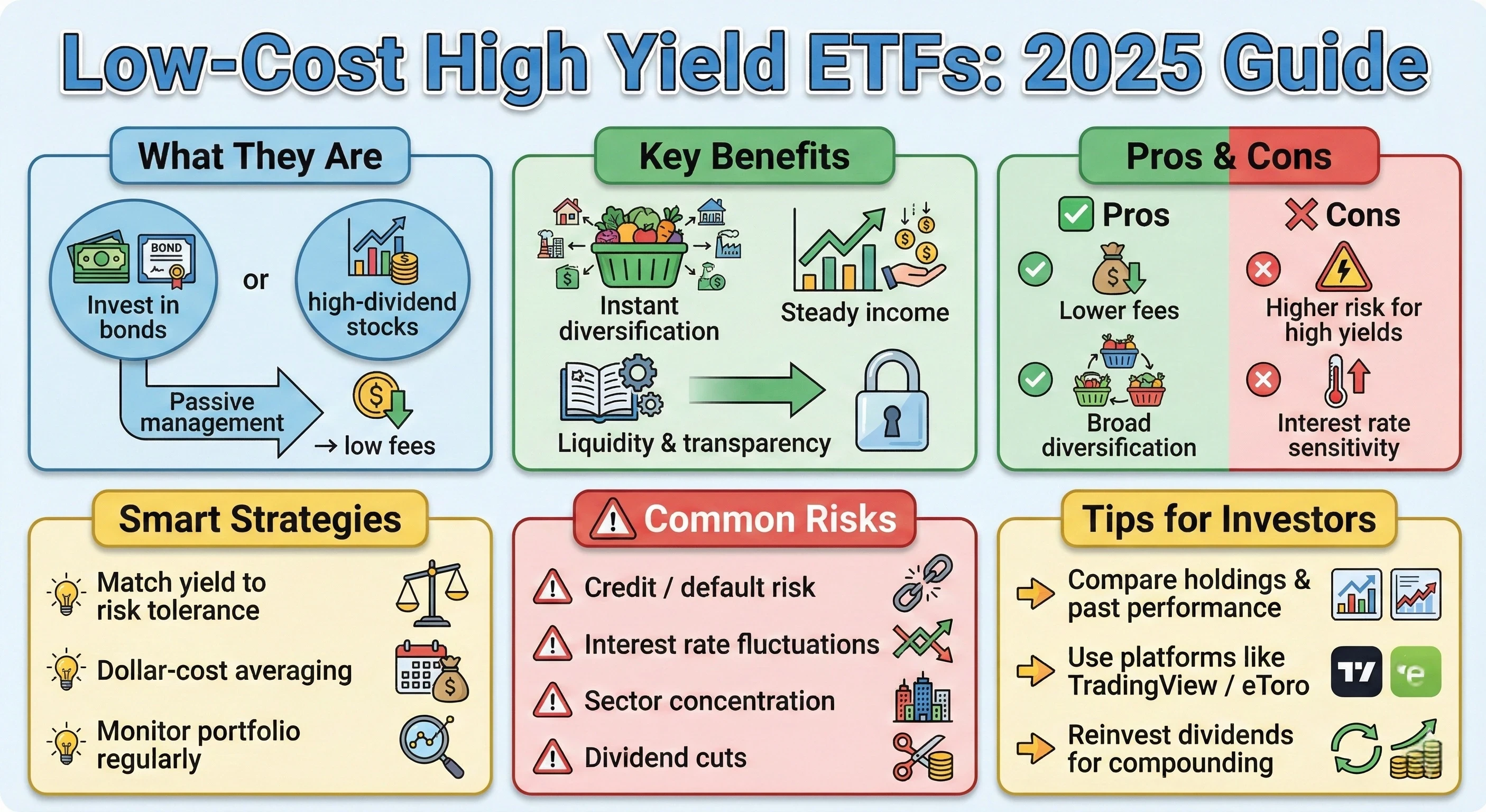

Low-cost high-yield ETFs offer a pretty straightforward value: higher income potential with access to diversified holdings, all without hefty management fees. Most of these funds focus on bonds, dividend stocks, or a mix of both. By keeping costs down, more of your returns actually end up in your pocket. For folks who are tired of seeing their profits eaten up by expense ratios, these ETFs can look really appealing.

The ETF space is growing fast, and yield-focused strategies are a big driver. As rates switched up over the past year and bond prices fell, yields rose along with the potential for better returns. But nothing comes without trade-offs. I’ve found that understanding both the rewards and the risks helps make sure you’re not just chasing the next financial trend.

If you’re new to this area, I recommend checking out my detailed post on the best high-yield ETFs for 2025 for specific fund ideas and how they stack up on fees, yield, and performance.

How Do Low-Cost High-Yield ETFs Work?

Low-cost high-yield ETFs invest in baskets of securities, usually bonds (like corporate or junk bonds), high-dividend stocks, or a blend. The idea is to scoop up securities that pay above-average yields, all while spreading risk across many issuers or companies. The “low-cost” part comes from passively managed ETFs, which follow an index and don’t require much hands-on management. That means lower expense ratios compared to traditional mutual funds.

Some of the main perks are:

- Instant Diversification: By buying a single ETF, you get exposure to dozens (sometimes hundreds) of assets.

- Lower volatility than single stocks or bonds: Not putting all your eggs in one basket helps soften the blow of any one investment tanking.

- Liquidity: ETFs trade like stocks, making them pretty easy to buy and sell.

- Transparent pricing and holdings: You always know what you own, unlike some managed funds.

I use TradingView for charts and real-time price monitoring on ETFs. The platform makes tracking performance a breeze, and there’s a ton of community insight as well. If you want to keep an eye on dividend events or bond maturity dates, TradingView’s alerts and analysis tools can give a boost to your tracking and help you spot trends early.

Current Investing Environment: Is Now a Good Time?

With so many macro mixups, like rising and falling interest rates, inflation, and changing economic growth, the timing of investing in yield-focused ETFs really depends on your goals. Yields are the highest they’ve been in years for some sectors, especially junk bonds and dividend-paying stocks. For income-oriented investors, this can look pretty good; you collect regular payouts while waiting for bond prices to bounce back.

However, high yields usually mean higher risk. Junk bonds pay more because there’s a greater chance of default, and high-yield stocks may be under pressure or in cyclical industries. If you only focus on chasing the highest yield, that could leave you exposed to sudden drops in price or income cuts down the road. Staying aware of what the ETF actually holds is super important here.

I recently wrote up my thoughts on low-cost ETFs compared to traditional funds, which covers exactly how these differences can affect you depending on the market cycle. Being sure about your own financial needs and risk tolerance is the best way to get a sense of whether these ETFs are a fit right now.

Pros and Cons: What to Consider Before Investing

- Pros:

- Consistently lower fees than actively managed funds or buying individual bonds.

- Broad diversification and steady payouts from stocks, bonds, or both.

- Easy to trade and monitor using online brokers or platforms, like eToro.

- Transparency, since ETF holdings are usually published daily, giving investors a way to keep tabs on exactly where they’re invested.

- Cons:

- Chasing the highest yield often means taking on more risk (credit, sector, or default risk).

- If interest rates rise suddenly, bond prices could dip and push total returns lower.

- Some funds slant toward specific sectors or countries, so you’ll want to check the fund breakdown.

- High turnover in some ETFs can lead to unpredictable income streams and greater tax complexity in taxable accounts.

Doing the math on expense ratios, tax considerations, and fund structure can help you decide if adding new funds to your mix is a good fit for your goals. Mixing in different ETF types (some high yield, some core, some international) usually helps balance steady income with less drastic price swings. Spreading investments across several sectors and regions can make your income flow more steady and lower your risk if one area stumbles.

Smart Strategies for Investing in High-Yield, Low-Cost ETFs

- Match Yield to Your Risk Tolerance: Don’t just go for the highest number. Make sure the yield fits your risk comfort, especially if you’re planning to use the income for spending or retirement.

- Think About Tax Implications: High yields can mean higher tax bills, depending on your region and account type. Taxable accounts might see more of your yield go to taxes, unless you’ve chosen funds that hold municipal bonds or are tax-efficient.

- Use Dollar Cost Averaging: Buy your ETF at regular intervals, which helps smooth out market swings and avoids trying to perfectly time the market.

- Keep Reevaluating: Yields change as interest rates and the market switch up. Checking in on your ETF lineup every few months helps you spot any funds that aren’t living up to your goals or are becoming too risky for your taste.

- Compare Fund Holdings and Past Performance: Take some time to look at what each ETF owns and how it did in different market environments. This can help you double-check that you’re not doubling up on risk.

Tools like TradingView and eToro offer research, screening, and news updates to make these steps a lot smoother. You can set alerts when yields hit a certain number or when underlying asset allocations change, so you’re not caught off guard by market moves.

Common Risks When Investing in High-Yield ETFs

- Credit/Default Risk: Especially in junk bond ETFs, if companies can’t pay debt, yields might drop, and so will prices.

- Interest Rate Risk: Bond values drop as rates move up, which can push ETF prices lower even if yields stay high.

- Sector Concentration: Some funds load up on energy, financials, or real estate, so problems in those sectors can hit harder.

- Dividend Cuts: High-dividend stock ETFs can cut payouts if companies run into trouble.

- Liquidity Risk: In rough markets, underlying assets may be harder to sell quickly, even if the ETF trades easily—this can mean bigger swings in ETF prices during market stress.

Doing some research helps buyers make informed decisions. I’ve got a quick guide to using low-cost high yield ETFs for retirement that goes into more depth, especially for folks with long-term timelines.

Frequently Asked Questions about Low-Cost High-Yield ETFs

Q: Do these ETFs offer reliable income?

A: Most of the time, yes. They tend to pay monthly or quarterly, but the exact payout can hike up or drop depending on what’s happening in the market and what the ETF actually holds.

Q: How do I pick the right ETF?

A: Look at the expense ratio, yield, diversification, and the kind of assets inside. Then, match those up with your goals and how much risk you’re happy to take.

Q: Are high-yield ETFs a good choice for a beginner?

A: These can work for beginners because they’re simple to buy and manage. Just make sure to research the risks (especially with junk bonds or narrow sectors) and avoid putting all your money in one fund. Diversification is key, and it’s smart to ease in rather than jumping in all at once.

Q: Can I reinvest the income automatically?

A: Yes, most brokers and platforms will let you automatically reinvest ETF distributions back into the fund. This can help your investments grow over time, making compounding work in your favor. If you want to maximize long-term growth, choosing reinvestment can make a real difference.

Bottom Line: Should You Invest in Low-Cost High-Yield ETFs Now?

Low-cost, high-yield ETFs can definitely bring solid income to your portfolio without racking up huge fees. That’s a huge win for both new and experienced investors. However, having a mix of income and growth and stepping back to double-check the risks always pays off. With interest rates and yields moving around, staying tuned in to the market and adjusting your plan as needed is super important. I use platforms like eToro and TradingView to research and manage my ETFs; both are worth checking out if you want tools to help guide your next moves.

If you want more real-world picks or examples, I’ve put together guides covering best high yield ETFs for 2025 and how low-cost ETFs compare with other fund types to help you figure out where high-yield ETFs fit with your bigger investing plan.

Smart investing is about sticking with a strategy that matches your needs, learning about the options (and the risks), and staying flexible as the markets change. Low-cost, high-yield ETFs are handy additions for a lot of folks, but a bit of due diligence goes a long way in making sure they work for you long term. By staying sharp and checking in on your investments, you can make the most of the strong income potential and ride out the bumps along the way.