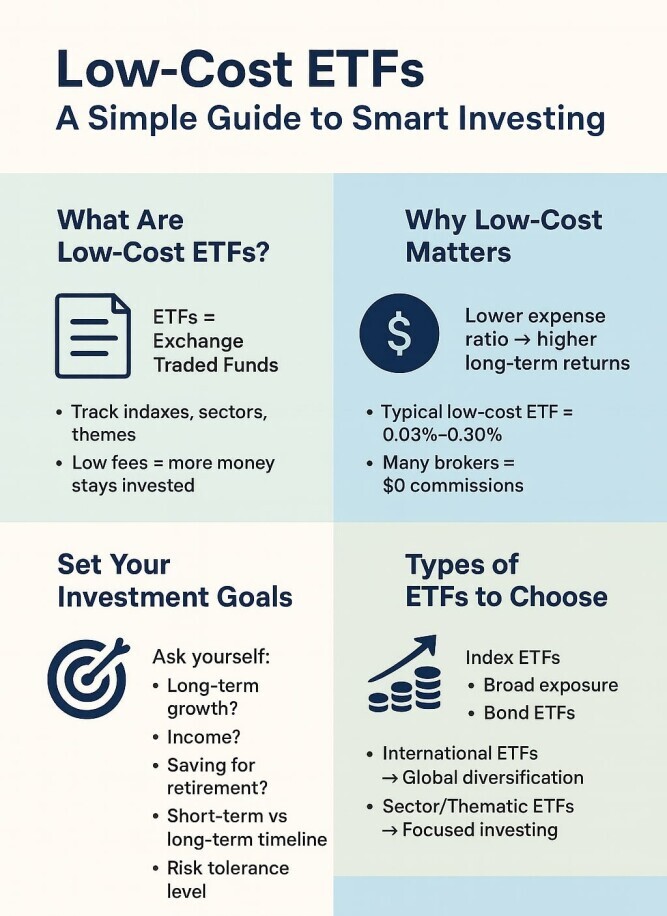

Low-cost ETFs have become one of my favorite ways to grow an investment portfolio without paying a lot in fees. ETFs, or exchange-traded funds, offer a simple and budget-friendly entry into the world of investing. Tracking major indexes, sectors, or even specific themes, these funds bring broad exposure and flexibility to the table, even if you’re just getting started.

With just a little research and a small starting balance, you can tap into the same strategies used by experienced investors. Leaning into low costs really matters because fees quietly eat into your returns over time. So, finding ways to keep those costs down is super important, especially if, like me, you’re thinking about long-term growth or even saving for retirement.

The good news is that getting started with low-cost ETFs is easier than it might seem. I’ll walk you through the key steps, what you need to look out for, and how to keep moving forward. If you want a deeper background on why low-cost ETFs matter, I often refer friends to my post on Understanding Low-Cost ETFs before they jump in.

Step 1: Know What Makes an ETF “Low Cost”

The main thing to pay attention to is the expense ratio. That’s the yearly fee a fund charges for overhead, management, and maintenance. With ETFs, some expense ratios are tiny, sometimes as low as 0.03% to 0.15%, which means you’re not handing over much of your gains. Consistently focusing on lower expense ratios is one of the easiest ways to keep your returns growing over time.

What Does ‘Low Cost’ Really Mean?

- Expense ratio is typically under 0.30% per year.

- No commissions for buying and selling (most brokers offer this now).

- Fewer extra fees, and usually no load fees.

This combination is what lets your money work harder for you, instead of for the fund manager. If you’re not sure which ETFs qualify, I put together a helpful breakdown in my guide on Low-Cost ETFs for Retirement.

It’s also smart to read up on each fund’s fact sheet or website to spot any hidden costs or related management structures. By digging into the basics at the start, you can avoid surprises down the line and be more confident in your investing choices.

Step 2: Figure Out Your Investment Goals

I always start by thinking about why I’m investing in the first place. Different goals call for different ETFs. For example, are you hoping to build a nest egg for decades from now? Or are you looking for something that generates income sooner? Setting clear goals helps remove uncertainty and makes it easier to select ETFs that align with your plans.

Many investors also like to review their goals yearly, adapting as life changes or benchmarks are met. Whether you’re planning for a down payment, saving for college, growing a retirement fund, or building a financial safety net, each scenario may push you toward different types of ETFs or portfolio balances.

Smart Questions to Ask Yourself:

- Is this for retirement, a big future purchase, or something else?

- How long can I leave my money invested?

- How much risk am I comfortable with, and can I ride out market ups and downs?

Your goals drive everything else, from the type of ETF you pick to how much you invest and how long you stay in. Keep these at the forefront as you build your approach.

Step 3: Choose the Right Type of Low-Cost ETF

The ETF universe is huge. Here are the main buckets I usually look at:

- Index ETFs – These track a specific index like the S&P 500. Great for broad market exposure and often extremely cheap.

- Bond ETFs – These focus on fixed income, so if you like things a bit more stable, they’re worth checking out.

- Sector and Thematic ETFs – If you want to target a certain industry or trend, these ETFs let you do it with one purchase.

- International ETFs – For global diversification, look at funds covering different regions or countries.

Most beginners start with something broad like an index ETF, but if you want to learn more about long-term strategies, I put together some ideas here: Long-Term Investment in Low-Cost ETFs.

Beyond that, many people experiment with small allocations in thematic or international funds, giving their portfolio added flavor and offering a way to learn about markets outside their home country. As you gain confidence, mixing in new funds can help add growth, yield, or a hedge against local market swings.

Step 4: Set Up Your Investment Account

To invest in ETFs, you’ll need a brokerage account. Thankfully, setting one up is pretty simple with most online brokers. I look for:

- No account minimums (or very low ones).

- Zero commission ETF trades.

- Easy-to-use interface and strong educational resources.

- Solid track record and good customer support.

Whether you use a traditional brokerage or a robo-advisor, make sure you understand any fees involved. Even those little charges can add up over time. Many platforms also offer educational tools and mobile apps to make trading ETFs easier, so take a few minutes to explore their features before choosing where to open your account.

Step 5: Build a Portfolio That Makes Sense for You

I like to keep things simple and balanced. Mixing different types of low-cost ETFs can give your portfolio a good mix of growth and stability. A common approach looks like:

- A large portion in a broad market index ETF (like S&P 500).

- Some in a bond ETF for smoother performance when stocks dip.

- Optional: Add a small dose of sector, thematic, or international ETFs for extra variety or personal interest.

Tips for Allocating Your Money:

- Spread funds according to your risk tolerance. More stocks means more growth, and more bonds or stable sectors can mean less volatility.

- Rebalance once or twice a year to stay on track as the market moves.

- Hold long-term and resist the urge to panic during short-term dips. History shows markets recover in time.

Learning to stick with your plan is really important for building wealth with ETFs. Over the years, I’ve seen that consistency in contributions, plus disciplined rebalancing and ignoring day-to-day swings, often lead to the best outcomes. If you want extra peace of mind, automate your investments so that fresh money hits your chosen ETFs monthly.

Step 6: Watch Out for Extra Costs and Taxes

Even the cheapest ETFs can have surprise costs. A couple of spots to watch out for:

- Bid ask spreads – The difference between what buyers will pay and what sellers want can impact your trade price, especially with low-volume ETFs.

- Capital gains distributions – Holding ETFs outside tax-advantaged accounts might trigger taxes if the fund realizes gains.

- Foreign taxes – Some international ETFs withhold taxes automatically. Look up the details if global investing appeals to you.

Tax-advantaged accounts like IRAs and 401(k)s are popular places for holding ETFs if you want to reduce taxes. If you’re investing for retirement, I often suggest learning more in my Low-Cost ETFs for Retirement post. It also makes sense to check with a tax specialist if your situation is complex or you’re planning big moves between accounts or countries.

Common Questions & Troubleshooting for ETF Investing

What if I’m starting with a small amount?

Plenty of brokers let you buy fractional shares, so you don’t need thousands to get started. Even $50 or $100 works as a first step. Over time, regular contributions—even if small—can add up significantly thanks to compounding returns.

What’s the difference between an ETF and a mutual fund?

They often hold similar investments, but ETFs trade on the open market all day, while mutual funds only trade at day’s end. ETFs usually have lower fees and are more flexible for regular investors. You might prefer ETFs if you want intraday trading, transparency, or simply lower ongoing costs.

Do I have to watch my ETF investments every day?

I rarely check daily. Monthly or quarterly peeks are usually enough unless there’s a big life or money change. Long-term investors benefit from tuning out short-term noise. Frequent checking can sometimes lead to unnecessary changes, so set a reminder to review your account at regular intervals and avoid emotional decisions.

Is it risky to put all my savings into ETFs?

Any investment has risk, and stocks do go up and down. Spreading your money across different assets with ETFs helps, but keeping some cash or safer investments is always smart for emergencies. You may also want to adjust your mix as you approach big financial milestones or retirement to keep risk levels in check.

Take Action: Easy Steps to Start Investing in Low-Cost ETFs

Investing in low-cost ETFs is one of the simplest ways to build wealth without getting hit with high fees. With the right mix and a little patience, your money can keep working for you for decades. You really don’t need a finance degree or massive capital to get started; just a bit of persistence and willingness to learn as you go.

Your Next Moves:

- Pick a trusted brokerage and open your account.

- Choose a low-cost ETF that matches your goal and risk level.

- Set up automatic monthly deposits if possible; it makes building your portfolio effortless.

- Check in every few months, rebalance as needed, and remember to stay on the course.

Have a low-cost ETF you’re interested in or want to share your approach? Drop your thoughts below or check out more tips in my other posts for deeper guidance. By sticking with low-cost ETFs and following a solid plan, you’ll set yourself up for financial growth—one step at a time.

If you’re curious about specific ETF ideas or how to handle changing market conditions, let me know. I’m always happy to dig into new questions, share personal experiences, or point you toward resources that make investing just a bit easier. And remember: the most important step is simply getting started.