High-yield ETFs are among my favorite ways to chase higher income without spending hours picking individual stocks or bonds. ETFs (“exchange traded funds”) bundle together a bunch of assets and trade on the stock market, making them pretty convenient to buy and sell. Some focus mainly on paying out a h yield, often by holding dividend-paying stocks or bonds. If you’re aiming to boost your passive income, the right high-yield ETF can really help, but not all are created equal.

With thousands of ETFs swirling around, it’s easy to get lost in the details or jump at anything promising a big payout. Chasing yield blindly can backfire, so a few smart steps will help you get the benefits without the extra risk. If you’re not sure where to start, this guide will help you sort through the noise and pick high-yield ETFs that fit your goals, without getting tripped up by sneaky pitfalls along the way.

Here’s how to approach high-yield ETFs with confidence, even if this is your first time giving them a serious look.

Step 1: Understand What Makes an ETF “High Yield”

Each high-yield ETF gets its label a little differently. Usually, you’ll see that because it focuses mostly on assets that pay above-average income, like high dividend stocks, corporate bonds, REITs (real estate investment trusts), or preferred shares. Some high-yield ETFs mix these, while others stick to just one area. It pays to look closely at what’s inside the ETF so you’re not surprised later. For example, a dividend stock ETF might yield less but offer more stability, while a junk bond ETF could have wider swings yet higher income potential. Whichever you pick, the makeup of the fund is key to understanding the risks and rewards you sign up for.

Common Types of High-Yield ETFs

- Dividend Stock ETFs – Mostly hold companies with strong, regular dividend payments. Great for those wanting income and some growth.

- Bond ETFs – Focus on government, corporate, or high yield (“junk”) bonds. Yields are often tied to interest rates and credit risk.

- REIT ETFs – Invest in real estate companies that legally have to pay out most of their income as dividends.

- Multi asset or Mixed ETFs – Blend a bit of everything to try to smooth out bumps and catch yield from many sources.

Knowing what asset class and strategy the ETF uses will help you match it with your expectations. Don’t forget to check out the prospectus and fact sheets for details about how a fund targets its yield, or whether there are any changes to its holdings over time.

Step 2: Clarify Your Income Goals & Risk Comfort

Chasing a fat yield is tempting, but I always try to remember that higher income often means more bumps along the road. Ask yourself what you want your ETF to do for you. Are you looking to stash away money and let it grow, or do you need regular payouts to help cover expenses? Also, think about how much risk you’re actually comfortable with. Some high-yield ETFs throw off bigger (but less steady) dividends than others. Getting a sense of your own comfort zone can help you avoid knee-jerk decisions later on.

Questions to Sort Out Your Priorities:

- Do you want a steady, predictable payout (like from established dividend stocks)?

- Are you okay if your ETF goes up and down a lot for a shot at higher rewards?

- Is this for a retirement account, or would you want quick access to cash?

Thinking this through helps you filter out options that might catch your eye for the wrong reasons. Remember, a steady income stream may sometimes be more valuable than chasing after the biggest yield available, especially if you rely on the payouts for living expenses.

Step 3: Watch Out for Yield Traps

Some ETFs flash super high yields to attract attention, but they might not be as stable or reliable as they seem. Sometimes those huge numbers are a sign that the assets inside are risky, the prices were recently hammered, or the fund is paying out more than it’s actually earning. I always double-check if that yield looks a little too sweet; if it jumps out compared to others in the same category, there’s usually a catch.

How to Spot Red Flags

- Compare the yield to similar ETFs—outliers can be risky.

- Look for recent big drops in share price; this can make historic yields seem temporarily higher.

- Check if the fund’s distributions include “return of capital”—sometimes you’re just being paid back with your own money instead of real gains.

In my experience, people can get burned by jumping at a chart-topping yield, only to see payouts cut or the ETF price tank. Doing a quick check for red flags can save you a lot of headaches later on. Even just reading reviews or discussion boards can help you spot patterns others have seen before you put your own cash in.

Step 4: Dig Into Fees and Expenses

Fees won’t show up in your account every week, but they eat into returns just the same. High-yield ETFs come with a range of “expense ratios” (shown as a yearly percentage), which is what you pay the fund company for managing everything. Some are cheap since they just track an index, while others charge more for active management that tries to maximize your yield by picking and choosing assets. Choosing a lower-cost ETF whenever you can lets you keep more of what you earn, because expenses cut right into your bottom line!

Fee Tips

- Lower expense ratios generally mean you keep more of the yield.

- Compare the fee versus funds with similar strategies; don’t pay for bells and whistles you don’t need.

- Be wary of hidden costs like trading spreads, which can add up when buying or selling shares.

I usually use the fund’s official page or a site like Morningstar (morningstar.com) to check expense ratios quickly. Remember that even small differences in fees can really add up if you plan to hold an ETF for many years. Don’t forget to look at any extra fees for transactions and consider tax impacts if these matter to your long-term returns.

Step 5: Check the ETF’s Track Record & Holdings

Even if an ETF is new, looking at how the underlying assets have performed can give you clues about potential ups and downs. If a fund’s been around for a while, I like to check both its total return (growth plus yield) and consistency. Has the income been fairly stable? Did the fund continue to pay out through market swings? If a fund’s past behavior is erratic, or if payouts wildly change from year to year, that’s usually a warning sign. ETFs that hold a solid roster of companies or bonds with long histories of paying dividends tend to offer more stability and reliability.

What I Look For:

- Several years of steady or growing payouts

- Reasonable bounce backs from market drops

- Holdings that make sense (not just a random collection of risky assets)

Transparency about holdings is really important. Some funds share a full list every day; others only give quarterly snapshots. More info means fewer surprises for you. Don’t hesitate to dig into fund documents or fact sheets to see exactly where your money is going.

Step 6: Understand How the Yield Is Paid

It’s easy to focus just on yield percentage, but how and when it’s paid can affect your cash flow. Most high-yield ETFs pay either monthly or quarterly, but the payout level can move around. I prefer funds with a history of reliable, straightforward payments, especially if I’m using the income for budgeting. The frequency of payments can be a big factor if you like to plan your monthly expenses or reinvest automatically.

Payout Details to Check:

- Payment frequency (monthly, quarterly, etc.)

- Stability or growth of payouts over time

- Tax treatment (sometimes a portion of income is taxed differently)

Reliable payment schedules make your financial planning way easier. Some investors like the predictability of monthly payouts, while others don’t mind a lump-sum payment every quarter if it better aligns with their spending habits.

Common Questions & Troubleshooting

What if a high-yield ETF suddenly cuts its payout?

This usually means trouble with the underlying assets or that previous payouts weren’t sustainable. I watch for trends; a single cut isn’t always a disaster, but repeated drops could mean it’s time to look elsewhere. Pay attention to news about the sectors your ETF invests in—big market shifts can affect even the steadiest funds.

Are high-yield ETFs good for long-term growth?

They’re mainly built for income, but some (especially those holding dividend stocks) can grow over time. If you want both growth and yield, try mixing growth-focused ETFs and high-yield ones in your portfolio. A blend of strategies can help you smooth out volatility and boost long-term returns.

How do I avoid putting all my eggs in one basket?

- Split your investment across different ETF types (stocks, bonds, REITs)

- Don’t chase just the highest yield; balance risk and return

- Review your portfolio a few times a year

Switching things up and reviewing your holdings can help you adjust to changing market conditions, and diversification helps cushion against surprises from any one fund or market sector.

Putting It All Together: Your Next Steps

Picking the right high-yield ETF means balancing payout, risk, fees, and your own goals. I like to remember that “higher yield” isn’t always better if it comes with extra headaches. Matching the ETF’s strategy to your comfort zone and income needs will set you up for fewer surprises and more dependable results. If you’re just getting started, don’t rush – start small, keep learning, and you can always add more later.

Your Action Plan:

- List your income and risk goals—decide what you really want from a high-yield ETF.

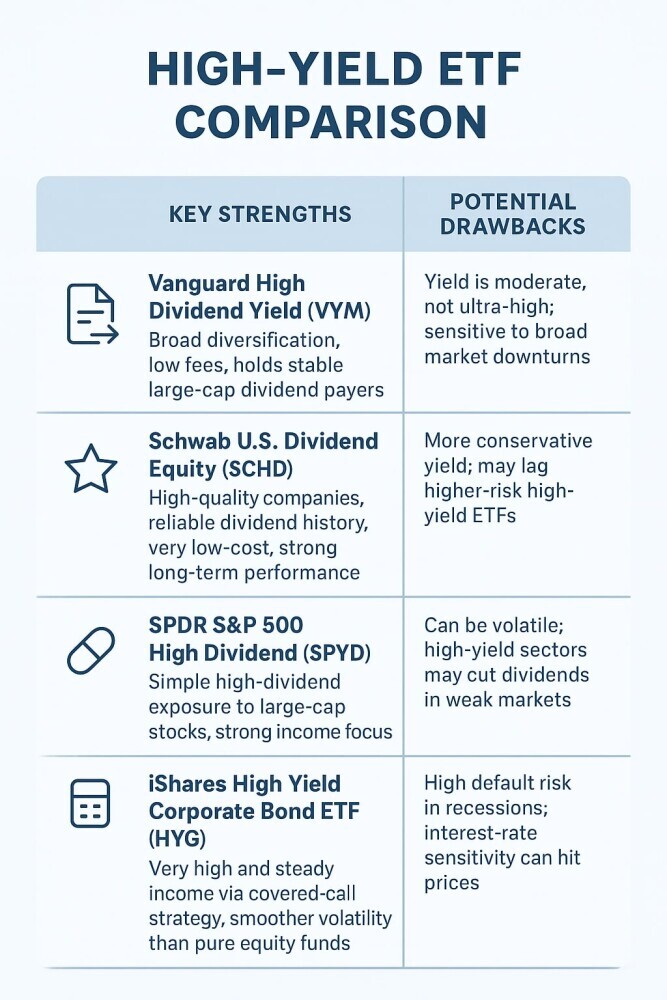

- Compare three well-known ETFs in the same category using fees, yield, and track record. If possible, check out investor reviews or analyst comments for extra perspective.

- Double-check holdings and recent performance before you hit “buy.” Be sure the fund is truly delivering what you expect.

Got a favorite high-yield ETF or one you’re wondering about? Share your questions and picks down below. Remember to keep educating yourself—sometimes the best insight comes from seeing what fellow investors are doing and learning from both hits and misses!