If you’re considering the idea of growing your investments without overspending, low-cost high-yield ETFs might catch your interest. These funds bring together dividend-paying stocks or bonds, attracting those who crave a mix of lower fees and steady income. This article will walk you through how these ETFs operate, reasons to check them out, the potential risks, and some smart steps if you’d like to begin investing yourself.

Disclaimer: This article contains affiliate links. If you open an account through these links, I may earn a commission at no additional cost to you. Investing involves risk, including the possible loss of capital. eToro is not available in all countries. Eligibility depends on your region. Always consider your individual circumstances before making an investment.

What is a Low-Cost High-Yield ETF?

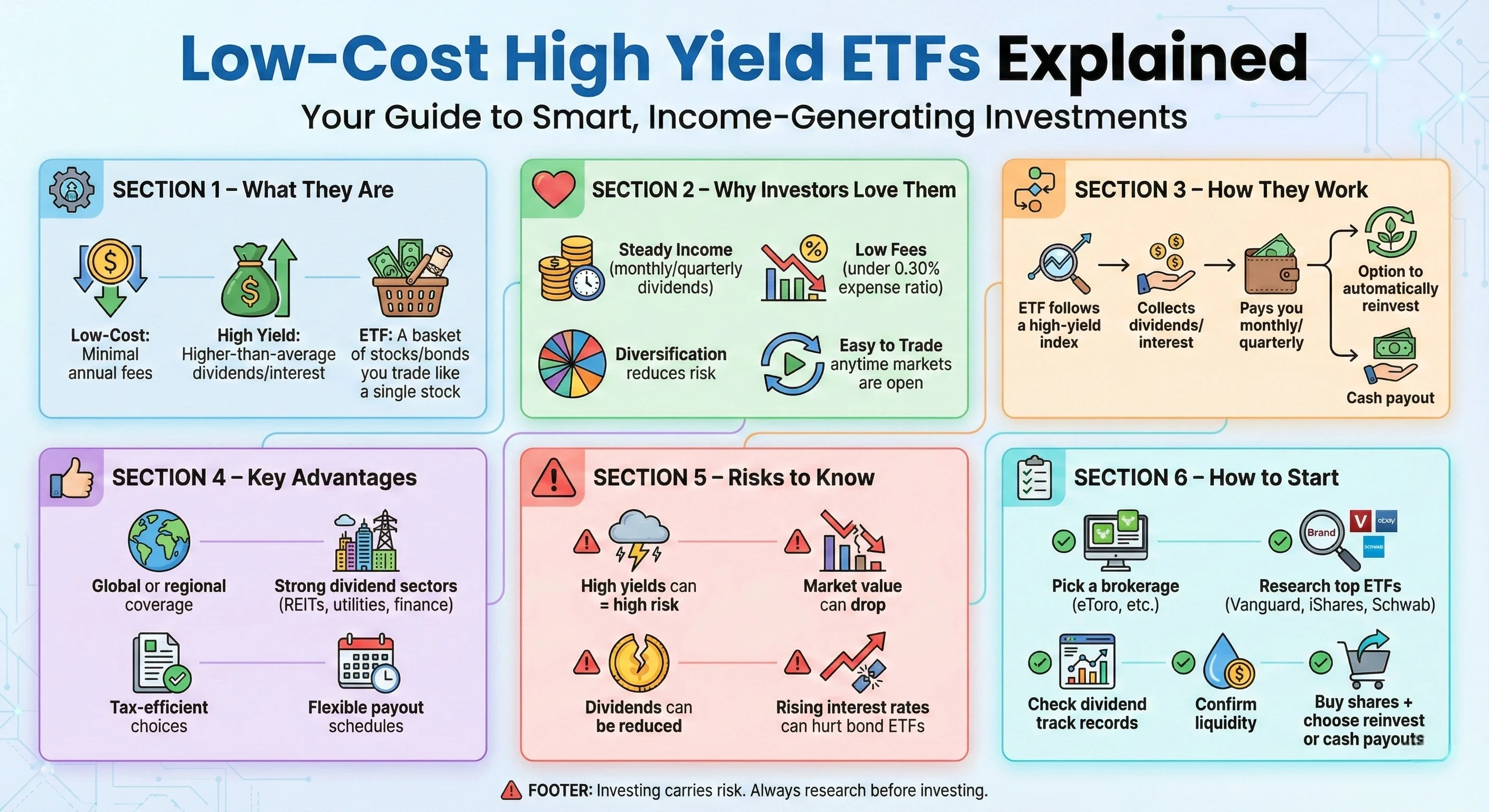

Although the term might sound like financial jargon, it’s simple once you break it down. An ETF—short for Exchange Traded Fund—pulls together a collection of investments, typically stocks or bonds, that you buy and sell on the stock market just like a regular share. Here are the details:

- Low cost: These ETFs charge much less in fees than most mutual funds. Since fees are subtracted from your investment each year, paying less means you get to keep more of your gains.

- High yield: These focus on investments that pay higher dividends or interest than average, translating to more regular income for you compared to most ordinary funds.

If you like getting paid while your cash is invested and would rather not pick individual stocks, these ETFs can be especially handy. They let you piggyback on the power of major companies or government and corporate bonds, all in one neat package.

Why People Are Into Low-Cost High-Yield ETFs

If your ideal investment involves reliable income with minimal costs, these ETFs deliver on both fronts. Here’s why they consistently win over both DIY investors and financial advisors:

- Steady Income: Getting dividends or bond interest on a regular schedule is very appealing. You can either reinvest these payments for future growth or use the cash—the choice is yours.

- Lower Fees: Traditional mutual funds come with higher expense ratios, eating into gains. Well-known ETF options usually stay well below 0.30% per year, helping you hang onto more profits.

- Built-in Diversification: Since each fund holds many different companies or bonds, a poor performer won’t wreck your portfolio. This reduces your risk and makes investing feel less stressful.

- Simple to Trade: ETFs trade on regular stock exchanges, so you can buy and sell any time the market is open—much simpler than dealing with more complex assets like real estate.

How Do Low-Cost High-Yield ETFs Actually Work?

These funds select stocks or bonds that pay higher than average dividends or interest. Typically, an ETF follows a specific investing strategy set by a market index. Here’s how it plays out:

- The manager (or algorithm) tracks a target index—like the FTSE High Dividend Yield Index—choosing companies or bonds based on their ability to throw off income.

- All dividends and interest payments are gathered in the ETF’s account.

- The ETF sends out income to investors—usually every month or quarter—straight to your brokerage.

If you want, most platforms allow you to automatically reinvest these payouts instead of taking the cash, helping your investment grow through compounding.

Distinct Perks That Make These ETFs Stand Out

Not all low-cost high-yield ETFs look the same, but you’ll find a few practical features cropping up over and over:

- Global or Regional Coverage: Some ETFs stick to U.S. companies, but many also branch out worldwide—adding opportunities for higher yields and spreading risk across markets.

- Sector Variety: These ETFs often favor sectors like utilities, real estate investment trusts (REITs), or financials, which usually offer reliable dividends and less price volatility.

- TaxSmart Choices: You’ll come across funds crafted for maximum tax benefits, including qualified dividends or municipal bonds that can give a break from hefty taxes in taxable accounts.

- Flexible Payout Schedules: Need monthly cash for bills or expenses? Some ETFs pay every month, while others distribute quarterly. Knowing your needs will help you pick the right payout style.

For updated ETF charts and dividend info, the free screeners at TradingView are beginner-friendly and simple to use, making it easier to spot the best options for you.

Things to Consider Before You Invest

No investment is risk-free. Before you jump in, take these points to heart:

- Yield vs. Risk: Extra high yields sometimes signal underlying risk—a shaky sector or a struggling company. High income can be tempting, but check for red flags before jumping in.

- Market Fluctuations: Even with regular payouts, the actual value of an ETF can jump up or drop, especially during economic downturns. If you need to sell during a market dip, you might not recoup everything you hoped for.

- Dividend Reductions: Dividends aren’t carved in stone. If a company faces headwinds, it could shrink its payout, affecting your income.

- Interest Rate Movement: Higher interest rates can slam bond-based ETFs, and sometimes make dividend stocks less appealing compared to new fixed-income investments.

Think about your individual goals and your comfort with risk before choosing an ETF.

Simple Steps to Get Started With Low-Cost High-Yield ETFs

It’s way easier now than before to begin with these powerful funds. Here’s how you can get started with minimum stress:

- Choose a Brokerage: Many popular online brokers and apps like eToro let you trade ETFs for low or zero fees. Research which platform fits your needs best.

- Research Suitable Funds: Search for low-cost ETFs by reputable brands (Vanguard, iShares, Schwab) and focus on their yield, sector breakdown, and how many holdings they have.

- Review Dividend Track Records: A steady, unchanged payout over several years signals reliability more than a large, risky one-off yield.

- Check for Liquidity: High daily trading volume makes buying and selling shares nearly effortless and protects you from wild price swings.

- Place Your Order: Set a budget, buy as little as a single share, and pick if you want dividends reinvested or paid as cash. Many brokers support simple, auto-investing plans.

Want to track your ETF performance or build a custom watchlist? Try TradingView for simple tools and stress-free charting—perfect if you’re still new to investing.

FAQs About Low-Cost High-Yield ETFs

If you’re curious or still have lingering questions, here are answers to some common ones new investors (including myself) usually have when getting into ETFs:

What’s a reasonable yield to look for with these ETFs?

Most high-yield ETFs offer between 3% and 8% annually. Anything much higher might signal added risk, so take a moment to check how the yield is being generated before jumping in.

Are these ETFs good for retirement accounts?

Generally, low-cost dividend or bond ETFs fit well in IRAs and similar retirement vehicles. Always review the fund’s stability before including it in a long-term plan.

How are these different from owning individual stocks?

Buying an ETF gives you stakes in many companies with one purchase, so you don’t have to follow endless earnings reports or worry about surprise dividend cuts. It’s more hands-off and usually less stressful.

Will I pay tax on my ETF dividends?

Yep—unless you park your ETFs in a tax-advantaged account, you’ll owe taxes on the income. Tax rules differ, so checking in with a tax pro beforehand is always smart.

Key Takeaways for New Investors

Low-cost, high-yield ETFs make it easy to build an income-paying portfolio. They work well for people who want steady, reliable payouts without getting bogged down by high fees or a lot of daily management. As with any investment, always research options carefully to be sure they match your own comfort zone and long-term goals. Mixing in some variety, sticking with low fees, and looking for long-term payout consistency puts you on a smart path for future growth.

If you’re ready to try it out, signing up at eToro or exploring ETF performance charts over at TradingView can get you going.