Building a diverse investment portfolio is a goal that most investors strive for, but selecting the right mix of assets can be quite confusing. I’ve checked out a lot of options, and low-cost, high-yield ETFs really caught my attention because they’re known for offering good income without a huge hit to your wallet. The question that comes up a lot is whether these ETFs can actually help with diversification, or if you’re just loading up on risk by chasing yield. I’ll break down what these ETFs are, how they work, and how to use them for diversification without letting your portfolio get out of balance.

Disclaimer: This article contains affiliate links. If you open an account through these links, I may earn a commission at no additional cost to you. Investing involves risk, including the possible loss of capital. eToro is not available in all countries. Eligibility depends on your region. Always consider your individual circumstances before investing.

Understanding Low-Cost High-Yield ETFs

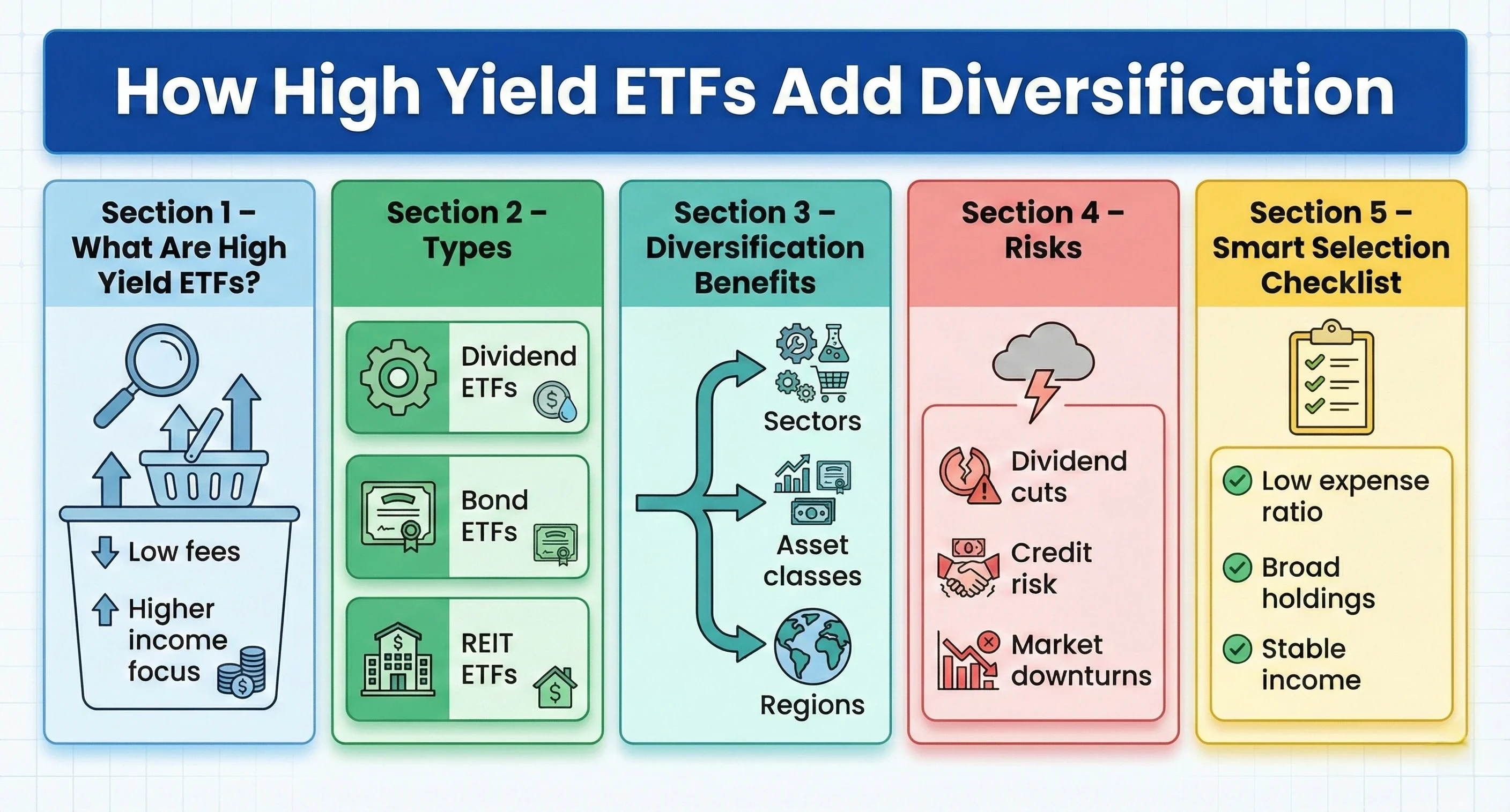

First off, here’s a quick breakdown: ETFs (exchange-traded funds) are investment vehicles that track a collection of assets, like stocks or bonds. “Low-cost,” in this context, just refers to funds with very low annual expense ratios, so more of your money is actually working for you, and less is getting eaten up by fees. “High yield” means these ETFs focus on assets that pay out higher than average income, such as dividend-paying stocks or bonds with above-average interest.

If you want to see exactly how they work, I’ve written a detailed guide on how low-cost high yield ETFs work that’s worth checking out for the nuts and bolts. In that guide, I break it all down, including the difference between dividend, bond, and real estate funds that offer high yields.

Income-focused ETFs have become a hot topic, especially among folks aiming for passive income or trying to step up retirement savings. In fact, BlackRock reports that assets held in ETFs have skyrocketed into the trillions, with a growing chunk of that money going into income-generating funds. Popular examples include ETFs that track high-dividend stocks, real estate investment trusts (REITs), or even junk bonds for a little extra yield.

Using High-Yield ETFs to Diversify: Does It Work?

This is where things get interesting. Diversification basically just means spreading your money across different types of investments so that you’re not putting all your eggs in one basket. High-yield ETFs can definitely help with this, especially if you choose ones that focus on different sectors, asset classes, or regions.

For example, you could hold a US high-dividend ETF, a global REIT ETF, and a preferred stock ETF. Each offers income, but from different corners of the market. Adding just one or two of these means your income isn’t only dependent on one set of companies or one sector.

- Equity High Yield ETFs: Focus on dividend-paying companies, often spread across sectors like utilities, consumer staples, and financials.

- Bond High Yield ETFs: Invest in corporate or emerging market bonds with higher interest rates.

- REIT ETFs: These cover real estate, which often swings differently compared to regular stocks and can add another layer of diversity.

Swapping out a single stock or bond fund for a high-yield ETF can open you up to a wide mix of holdings. But, like anything else in investing, there’s a flip side. Some high-yield ETFs can be concentrated in a few sectors, or rely heavily on one type of risk (like junk bonds), so it’s really important to look under the hood at what you’re actually owning.

Another good point to mention is that not all high-yield ETFs are created equal. Some might carry extra risk from international currencies, political instability, or simply from the underlying companies being overleveraged. That’s why I always give a once-over to any ETF’s prospectus before putting money in.

What to Look for in a Low-Cost High-Yield ETF for Diversification

I don’t just add any ETF that pops up with a high yield. The trick is to be picky so that you’re not accidentally taking on more risk than you want. Here are the main things I pay attention to when picking ETFs for a diversified portfolio:

- Expense Ratio: Even a fraction of a percent can eat into your long-term returns, so sticking to funds with expense ratios under 0.25% is my rule of thumb.

- Holdings Spread: Taking a look through the list of holdings tells you whether your ETF is truly diversified or just stacked with a few similar stocks or bonds.

- Yield Consistency: Big yields look eye-catching, but sudden spikes and drops in income might point to problems under the surface, like payout cuts or highly volatile holdings.

- Liquidity: Funds with higher trading volumes are easier to buy and sell, and usually come with smaller bid/ask spreads, saving a bit more on every trade.

- Tracking Index: Some ETFs track popular benchmarks, while others follow more concentrated or unique indexes. I stick with funds tracking indexes that actually make sense for what I want to achieve.

Useful research tools like TradingView (check it out here) offer pretty super detailed breakdowns of ETF holdings, historical performance, and even how funds performed in volatile markets. Those details really help when comparing one high-yield fund against another. I found that layering in data from multiple sources, like Bloomberg and Morningstar, can give a deeper picture of how stable an ETF’s income really is over time.

Pros and Cons of Using High-Yield ETFs for Diversification

- Pros:

-

- Access to diverse asset classes through a single ETF.

- Potential for consistent income, especially helpful for retirees or those trying to create a steady cash flow.

- Lower costs than many actively managed funds, thanks to the ETF structure.

- Trades throughout the day, with helpful tools for analysis on platforms such as TradingView.

- Cons:

-

- Some high-yield sectors (like MLPs or junk bonds) can react poorly in a market downturn.

- Dividend payments aren’t guaranteed and can get cut during rough economic times.

- Potential overlap in holdings if you’re not careful, leading to unintended concentration.

For a deeper look into the pros and cons of these funds for retirement, check out my breakdown on using low-cost high-yield ETFs for retirement savings. In that article, I fill in the gaps on how retirees can use these ETFs for consistent income and what pitfalls to watch out for.

Common Mistakes and How to Avoid Them

- Chasing Yield Without Looking at Risk: Sometimes the highest yields are a sign of stress, so balancing income with stability is really important.

- Ignoring Sector Overlap: Two different high-yield funds might end up holding the same top stocks. Using a handy ETF screener to compare holdings helps spot this.

- Focusing Only on U.S. Funds: Adding global or emerging market ETFs, or even REITs from overseas, spreads your risk and potentially gives your portfolio a boost in resilience.

In addition to these, some investors forget to keep an eye on rebalancing. If one section of your portfolio starts to dominate, your overall risk could creep higher than you realize. Setting a calendar reminder to review your asset allocation every six months can help keep things balanced and stress-free.

Getting Started: Building Your Diverse, High-Yield ETF Portfolio

- Determine Your Goals: Decide if you’re looking for income, growth, or a mix of both. This step sets the direction for your ETF selection.

- Research Different High-Yield ETF Types: Split your selections between US stocks, global stocks, bonds, and REITs for better balance. Mixing in emerging markets or sector-focused ETFs can add some variety.

- Watch Your Costs: Stick with low expense ratios, and beware of hidden trading fees or spreads. Even small costs can add up over time, so being cost-conscious really pays off.

- Regularly Rebalance: Over time, one ETF might start making up too much of your portfolio. Rebalancing keeps everything in check and reduces the temptation to let winners run unchecked.

- Use Robust Platforms: Trading platforms like eToro allow you to quickly buy or sell popular ETFs, track performance, and even see what more experienced investors are holding.

Through steady research, a bit of trial and error, and some patience, I found it gets a lot easier to smooth out the rough spots and keep the income flowing without letting risk sneak up on you. Don’t be afraid to start small and gradually build confidence by tracking your results and tweaking your strategies over time.

Advanced Strategies for Power Users

More experienced investors might want to mix together high-yield ETFs with growth funds, low volatility ETFs, or alternative assets. One handy move is to pair bond high-yield ETFs with equity dividend ETFs. This spreads the risk around when the stock or bond markets get choppy. You could also look at options strategies like writing covered calls on top of high-yield ETFs. That gives income a little boost, but it’s definitely getting into more advanced territory and requires a good understanding of options risk.

Platforms like TradingView bring a lot of analytic firepower for testing portfolios and pulling together historical risk and performance stats. The added data helps make smarter choices, especially if you like to dig into the details or analyze sector rotations.

Another advanced move is to mix in factor-based ETFs, like those tilted toward value or low volatility. By layering these alongside high-yield products, you can aim for both income and downside protection. This strategy can help smooth returns over time and reduce the pain of sudden market drops.

Frequently Asked Questions

Question: Do I pay extra taxes on dividends from high-yield ETFs?

Dividends from these ETFs are generally taxed as income in the year you receive them, though the rate can change depending on your country and the ETF’s structure. Some may qualify for lower capital gains tax, but always double-check with a tax professional for specifics about your situation.

Question: How do I know if my ETF is really diversified?

Always check the full list of holdings either directly on the ETF provider’s site or using investment platforms and screeners. More holdings, spread across sectors and regions, usually means better diversification. Also, check for overlap with your other funds to avoid accidental concentration.

Question: Can I lose money in a high-yield ETF?

Just like any investment, you can lose money if the market moves against you or if the underlying companies cut dividends. Spreading your picks across multiple ETFs and asset classes can help cushion the ride and reduce single asset risk.

Adding low-cost high-yield ETFs to your portfolio can definitely give you a solid mix of income and diversification, as long as you’re paying attention to what you’re actually holding. Taking a smart, research-driven approach keeps your portfolio balanced and your goals on track. Remember, balance and patience are your best friends in crafting a mix that works for the long haul.

Want hands-on experience finding and managing ETFs? Give eToro a try for an easy way to buy, track, and manage your ETF picks, or use TradingView to take your research to the next level. You can always start small and build up over time as you find what works for you.